Legal Blog

Knowledge is Powerful

National Homeownership Month: Building Financial Strength

Every June, we celebrate National Homeownership Month—a time to reflect on the significant role homeownership plays in financial stability and wealth-building. Whether you're already a homeowner or...

Read more

Spring Clean Your 401(k): Refresh for Financial Success

The arrival of spring isn’t just a time to dust off the cobwebs; it’s an opportunity to refresh and rejuvenate various aspects of our lives, including financial plans. Managing employee benefits,...

Read more

Social Security Fairness Act: Impact on Retirees Explained

The Long-Awaited Change: What the Social Security Fairness Act Means for YouImagine dedicating your life to public service, only to discover that your Social Security benefits are significantly...

Read more

MOVE?

I really liked this week’s article because it reflected a conversation I had with a friend the other day. We were discussing how retirement cash flow needs have so much to do with where you live....

Read more

FILET MIGNON AND A WINE TOUR

When was the last time you thought about retirement in terms of the pleasures it could bring you instead of in terms of the fear of having enough money to last? I thought about that when I read...

Read more

RETIREMENT READY QUIZ

From time to time clients will ask me about on-line tools they can use to help analyze and judge their preparations for retirement. Sometimes it is beneficial to insert various figures into an...

Read more

You don’t have the Virus but your losses are still huge

You don’t have the Virus but your losses are still hugeWe are receiving calls from clients fearful that their market losses are going to require them to claim social security benefits years earlier...

Read more

Perception May be Reality

This week’s article about retiring is written by a psychologist who has researched perception and applied that knowledge to financial situations. The author tells us “By the time most of us reach...

Read more

It’s Time to Come up with a Plan

We can’t control the impact Covid-19 has had on our savings, so maybe it’s time to come up with a plan and move forward. Yahoo finance shows us that the stock market is down 20% to 30% from the...

Read more

We are here for you

We’ve always told you that we are here to help. That means in connection with choosing retirement savings options that make you feel good about your future. But that also means to provide...

Read more

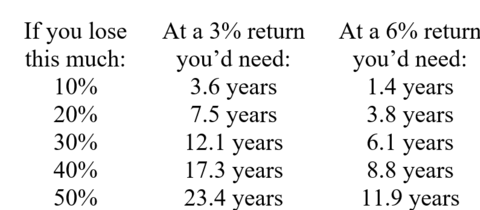

How many more years do you need to live in order to wait it out?

With all that is going on in the market with the Coronavirus, we have received many requests to give our opinion on how long it will take for a retirement savings to get back to the level it was...

Read more

We know you are concerned

Financial concerns stemming from the coronavirus outbreak have saturated the thoughts of anyone with a retirement nest egg set aside. The coronavirus has had an undeniable impact on any of us who...

Read more

Safety planning for retirement

I found this week’s article full of interesting information, and was drawn to the opening paragraph that I thought to share with you. “As we progress through life, we find there are certain things...

Read more

Get back on your feet

This week’s article references how setbacks can affect family decisions, and finances, at every live stage, but it tells you to “Get back on your financial feet even if you’re getting a late start....

Read more

Building your own

We often hear that “the key to feeling confident about a comfortable retirement is an employer plan”, but what if you don’t have one? I thought to share this week’s article with you because it...

Read more

Did you know?

Did you know about the new Secure Act which allows you to wait longer before you have to start withdrawing money from your qualified retirement accounts, such as your 401(k) or IRA? I thought to...

Read more

Is retirement good for health or bad for it?

I read an article this week that I thought to share with you as it expressed something I’ve been reflecting on. The author, connected with Harvard, wrote that “For many people, retirement is a key...

Read more

Have you determined which is best for you?

You may have heard about annuities elsewhere, but we thought it useful to send you a link to a Yahoo Finance article that does what we think is a good job of explaining that “Fixed indexed...

Read more

A bigger contributor to retirement security?

I read an interesting “framing paper” written by two learned scholars from Brookings Institution and Kellogg School of Management. The question they addressed revolved around the change in what...

Read more

Optimism that Threatens

I thought to share with you this week’s article because it provided an abstract of a study done that concludes that “a disturbingly large number of investors think they are on a path toward a...

Read more

Convert Savings into Spending

The Brookings Institute recently published a study where they reported that “in a recent nationwide poll, 73 percent of Americans said they do not have the financial skills to manage their money in...

Read more

Receive What You are Entitled to

This week’s article reminds us “given that an employee may have worked for several employers, who may have merged, sold their plans, or gone bankrupt, it is very difficult for the average person to...

Read more

Some Differences to Reflect on

As you enter a new year thinking of the changes you will make in the months to come, I thought to share with you an article that discusses differences that may relate to decisions you will make in...

Read more

Holiday Season

During this holiday season it is important to take a moment and acknowledge that no matter where we are in our retirement planning, we are joined together with gratitude at celebrating the...

Read more

A Growth Vehicle plus Guaranteed Income

This week’s article discusses something we don’t always focus on when it comes to our retirement objectives; we want both growth and income. While for sure we don’t want to lose any of our initial...

Read more

Silver is the New Green

When I saw the phrase “Silver is the new green” in this week’s article I knew I had to share the article with you. “Aging is”, as the article says, “an opportunity”, and “the changing landscape...

Read more

Identifying Retirement Income Gaps

Commentary:This week’s article provides a budgeting exercise “to identify potential income shortfalls” so that you can think about what options you have to cover life’s unexpected expenses. Call us...

Read more

Game Ready

Commentary:“Just like many big life moments such as getting married, or expanding your family, you need a plan and check-ups along the way. Retirement is no different. Your financial health can use...

Read more

Family Ready

Commentary:Many think of a fixed indexed annuity only as it relates to themselves and as a way to obtain an income they can’t outlive in our retirement; but this week’s article tells us to be...

Read more

How do I compare to my colleagues?

Often, when we see statistics of what others are doing, we try to distinguish ourselves by saying ‘They’re different from me’. Interestingly, that may be the case when comparing retirement...

Read more

A Very Long Time

“One of the biggest challenges in retirement is building a reliable stream of monthly income to support you for what could be a very long time. While retirees have long relied on bonds for this...

Read more

Master of Retirement

This week I thought you might want to “become more educated when it comes to retirement planning, especially as one in five Americans have absolutely nothing saved for their golden years. Enhancing...

Read more

Population Aging

Did you know that changes in the distribution of age in the US population over the past years has accounted for about one-fifth of the increase in the expenditures for services versus goods? This...

Read more

Want to Accumulate?

Did you know that if you need “insurance for as long as you live and want to accumulate savings a universal policy” might be something you want to consider as a choice. Sometimes people “take a...

Read more

Retirement Calculators

Are you on track for where you need to be for retirement? This week I thought to share with you several calculators. “These customizable calculators will allow you to run different scenarios and...

Read more

Transform your Stress

This week’s article tells us that “Financial stress is the number one source of stress for employees, according to a Price Waterhouse Coopers 2019 survey. Financial matters outrank any other source...

Read more

“It’s No Myth, Lack of Diversity Puts Retirement At Risk.”

This week’s article tells us “to diversify, products like a fixed indexed annuity can offer balance, growth potential with principal protection, and a steady income stream during retirement.” Don’t...

Read more

The Crisis

I read an article the other day that, while written a few years back, seemed to resonate even more today. The author wrote “More dangerous yet is the shift in focus away from retirement income to...

Read more

Boost your Financial Education

It’s back to school month, and regardless “if your household doesn’t include school-age children, you can still take September as a time to reevaluate your personal development and consider areas...

Read more

Pensionize

I came across an article from the past that caught my eye. It tells us that “Entering retirement can be a particularly jarring experience for seniors, and not only because they’re leaving behind...

Read more

Transform Stress into Confidence

This week’s article reports that “Financial matters outrank any other source of stress combined, including health and relationships.” Not surprising when so much in our lives depend on how much...

Read more

Volatility

This week’s article states “Second-quarter market volatility is making Americans increasingly worried about their finances and retirement savings, with only 31% in a new survey saying they were...

Read more

Counterintuitive Thought

“Here’s a counterintuitive thought:” Healthy consumers “are likely to have higher medical costs in retirement than their less-healthy counterparts.” This means that income in retirement may be...

Read more

Were you Aware?

This week’s article relates back to June being Annuity Awareness Month, and lists five things that pre-retirees should know about annuities. The first point the article references is that Fixed...

Read more

Is your Back to the Wall?

We already know that reports were issued a few years back telling us that the U.S. recession took its toll on seniors, and that “America’s senior citizens have their backs to the wall” especially...

Read more

Check-up on the Way

“You don’t leave your physical health to chance so why risk your retirement health?” I thought you might be interested in the financial health checklist in this week’s article because it mentions...

Read more

Annuities: Why You Need To Know How They Work

“You need to know how they work, because many financial planners recommend them to their clients for retirement planning purposes. In fact, one study shows that almost 90% of planners recommend...

Read more

Explore Diversified Options

This week’s article tells us “Diversifying your portfolio means balancing risk and growth. One option you might consider when forming your plan is fixed indexed annuities (FIAs). Designed for the...

Read more

In the News

It is important to understand certain products being discussed in the news as it relates to proposed changes with your qualified 401K funds. The changes are being reported as coming about due to...

Read more

Retire Your Risk

Will your monthly income plan provide you with the money you need? “Retiring comfortably is a goal shared by most. Annuities can provide guaranteed income every month with growth potential.” This...

Read more

Can Your Kids Ruin Your Retirement?

This week’s article illustrates what the author calls “one of the biggest threats to your retirement – – your kids.” He tells us that the percentage of 25 to 35 year olds living at home is ”almost...

Read more

Retirement Challenges for Those in Physically Demanding Jobs

Commentary:I read about a study I thought might interest you. “This report examines the retirement readiness of people who are in physically demanding jobs. Due to the strenuous nature of their...

Read more

The Role of Confidence

This week’s article discusses how owning a certain financial product can influence on an emotional level the confidence that retirees feel. Researchers interviewed “income annuity owners to provide...

Read more

Grumps and Complainers

This week’s article out of London begins by telling us that in that city, known for “grumps and complainers”, a new study reveals that retirees with a guaranteed lifetime income stream can find...

Read more

What is your RISE Score?

Did you know that there is a Retirement Income Security Evaluation Score (RISE Score™) much like a credit score on a zero to 850 scale, but for your retirement. “The purpose is to provide you with...

Read more

LOOKING BACK ON RETIREMENT PREPARATIONS

Sometimes hindsight can provide a valuable lesson. While retirement is highly personal, I thought you might find it interesting to read the result of a study that looked back on what the financial...

Read more

EFFICIENCY

This week’s article tells us that “Annuities are one of the most efficient ways to generate guaranteed income. This is demonstrated through a series of three case studies which looked at...

Read more

DON’T ASSUME

Commentary:I read an interesting study the other day that I thought to share with you. The study discussed something that we may incorrectly assume will happen as we continue to plan for our...

Read more

THE POWER

“Every retirement is different, each with its own financial plan and unique needs, but many of today’s retirement goals include achieving asset protection, growth opportunities, and a reliable...

Read more

YOUR TOP ASSET: TIME

I read a flyer the other day that caught my eye. It said “Losses can be recuperated but time cannot.” So true. What to do when losses have been incurred but you are later on in years can be a...

Read more

WHAT CHOICES WILL YOU HAVE?

This week’s article poses a familiar scenario and then tells us our choices in a very simple way: “Let’s say you have built up a retirement fund of $250,000 by the time you are age 65. Few of us...

Read more

DIFFERENT FOR WOMEN

This week’s article discusses three retirement savings factors relating to why it is different for women in retirement. While many of us may already have reflected on a female being projected to...

Read more

YOUR MONEY AND YOUR LIFE

“An annuity can be a very smart retirement investment for many people. That’s not just because an annuity can provide a secure revenue stream — a monthly check — for the rest of your life, no...

Read more

ASSETS VERSUS INCOME

I came across an article in the Harvard Business Review where the author discussed a concept we have touched on in the past – the idea that when you “ask someone what her pension is worth, she will...

Read more

UNDERSTANDING THE KEY ELEMENTS

I thought you would want to read this week’s article because it discusses that “while annuities and life insurance both have similarities, they are not the same. Before you can understand the...

Read more

UNLESS YOU ARE WARREN BUFFET

This week’s author, formerly with the Federal Reserve Bank of New York and the National Bureau of Economic Research writes that while not applicable to Warren Buffet’s retirement plan, “Retirees...

Read more

WHAT IF THE MARKET GOES UP?

The author of this week’s article provides an explanation for “Why an FIA is better than stocks” and asks us “Which is better? Having to time the market right or not having to worry about that?...

Read more

AFTER A VOLATILE END TO 2018

“Wary investors may be searching for stability in 2019.” So what should people consider? The author of this week’s article states that “Risk tolerance and time horizon play big roles in deciding...

Read more

TOP TWO REASONS

This week’s article discusses a new retirement institute study of annuity owners which found “the top two reasons consumers buy annuities are to supplement Social Security/pension income and to...

Read more

JOIN THE CLUB

This week’s article caught my eye at the outset when it stated “In case you didn’t know, there is such a thing as a lifetime income club. Of course, it goes by another name: annuities.” The author...

Read more

THE BIG SURPRISE

Have you ever thought about why people haven’t saved more for their retirement? “Financial shocks leave a mark on financial outcomes such as your ability to retire,” said one of the authors of RAND...

Read more

GOALS

With the New Year, we often reflect on goals and resolutions. This week’s article tells us “Surveys of retirement-age baby boomers indicate they no longer seek high growth in their portfolios....

Read more

HEALTH AND MONEY

Did you know there are studies that indicate health declines with retirement, and thus health costs increase. “For many people, retirement is a key reward for decades of daily work—a time to relax,...

Read more

ROLE IN RETIREMENT PLANNING

This week’s article tells us that “Annuities play an important role in retirement planning by helping individuals guard against outliving their assets. In the most general sense, an annuity is an...

Read more

A COMPLEMENT

“An annuity serves as a complement to other retirement income sources, such as Social Security and pension plans.” One of the reasons is because “all the money you invest compounds year after year...

Read more

FREQUENTLY ASKED QUESTIONS

It is always important to “get the answers you need to help calculate your path to retirement.” This week’s article goes a long way toward helping you navigate the way by providing information...

Read more

ONE SOLUTION TO THIS PROBLEM

Did you know that “recent studies put the “retirement income gap,” the difference between the amount of money retirees have saved and what they need to maintain their standard of living in...

Read more

CONFIDENCE

The Stanford Center on Longevity published an article that I thought you might like to read. While it said “current studies show that individuals’ confidence in the ability to retire comfortably,...

Read more

INCOME OUTSIDE OF SOCIAL SECURITY AND PENSIONS

With fewer and fewer companies funding retirement plans, “retirees have become dependent on savings that are often inadequate to fund their retirements. Recent studies put the “retirement income...

Read more

AGING IS AN OPPORTUNITY

“Around the world, people are living longer as birth rates decline. As this dramatic shift in global demographics escalates, both public policymakers and the private business sector must reevaluate...

Read more

OCTOBER MARKS THE MONTH

Did you know that “October marks National Financial Planning Month, a time when Americans can look at how they are saving, their retirement goals, and how they can create a tailored approach that...

Read more

PICK UP WHERE SOCIAL SECURITY LEAVES OFF

Did you know that among the tools that is being promoted as trying to give Americans a better shot at a more secure retirement are Fixed Index Annuities. At its simplest, an annuity is something...

Read more

HAVING YOUR CAKE AND EATING IT TOO!

I thought you might be interested in this week’s article because it mentioned a goal that I have been hearing more and more people mention in recent weeks. The author asks if you are seeking “a...

Read more

UNDERSTANDING

When making decisions about retirement, whether it be when we will take it, or how we will fund it, sometimes all it takes is a better understanding of what the options are. That’s why this week I...

Read more

INSECURE

I was taking a look at a 2017 survey that was called “America is Incredibly Savings Insecure” wondering if much has changed in 2018. “Nearly 90% of Americans are not very confident in their overall...

Read more

ANNUITIES

This week’s article tells us that “Annuities play an important role in retirement planning by helping individuals guard against outliving their assets.” One of the most stressful aspects of...

Read more

IMPORTANT ROLE

This week I thought to share with you an article that references the important role Annuities play in retirement planning by helping individuals guard against outliving their assets. “In the most...

Read more

VIDEOS SAY A LOT

“We all want a retirement plan that is ready for anything.” This thought often comes to mind and because fixed indexed annuities are a retirement savings vehicle that can help round out your...

Read more

ENSURING INCOME

A few years ago the Government Accountability Office (GAO) issued a report that highlighted the role annuities can play in helping people secure enough income during retirement. The report, which I...

Read more

FOR RETIREMENT SAVERS

From time to time it is a good idea to review basics, and re-educate ourselves on all available options for planning and evaluating our retirement savings plans. This week I came across several...

Read more

DO YOU CRAVE IT?

This week’s article tells us that people crave income in retirement, and that “the appeal of lifetime income is clear in a recent study: Six in 10 people ages 55 and older place a high value on...

Read more

NEVER FALL BELOW ZERO

This week’s article says that if you “need your earnings to never fall below zero or you want growth potential, coupled with principal protection from market loss or you seek a guaranteed minimum...

Read more

RETIRE YOUR RISK

“You’ve lived with risk, don’t retire with it.” The opening line of this week’s article caught my eye and I thought it might do the same with you. If you are one of the many of Americans who “are...

Read more

TERMS

From time to time it is a good idea to review the meaning of terms used when we discuss products that may help you plan your retirement strategies. This week’s article does just that, and provides...

Read more

MANY USEFUL PURPOSES

This week’s article lets us know that annuities can serve many useful purposes. “If you are in a saving-money stage of life, a deferred annuity can help you meet your retirement income goals, help...

Read more

PROTECTION FOR YOUR EGG

This week’s article tells us that FIAs protect your nest egg. “Nearly 90 percent of Americans lack confidence in their retirement savings (IALC data, October 2017). FIAs provide peace of mind and...

Read more

HEDGING AGAINST SOMETHING BAD

This week’s article spoke about annuities offering “a hedge against something bad happening to your money, like a huge loss in a stock market collapse. Instead of personally managing your money and...

Read more

FUEL FOR RETIREMENT

We read an article the other day from a library of information we have access to and thought it would interest you to know that it discussed “higher interest rates, of course, mean higher payout...

Read more

BALANCE

When you think about the things that fill your life what are you goals? Most people will say that a work-life balance is important. When you think about retirement, do your thoughts also lean...

Read more

RETIREMENT PLANNING WORKSHEET

With a title like “Sharpen your pencils, let’s work the numbers” I knew you would enjoy being provided with the opportunity to see how ready you are for retirement, and if your numbers add up to...

Read more

DIFFERENCES

Did you know that your readiness for retirement may vary depending on your occupation? This week’s article sets out a “Retirement-Readiness Score by Industry” and provides information to understand...

Read more

BASICS AND BALANCE

This week’s article “Fixed Indexed Annuities 101” made me smile because it brought back memories of my younger days in school, and I was reminded that even as we grow older, especially when...

Read more

SOCIAL SECURITY EARLIER?

The article I thought to share with you this week tells us that ” If you will celebrate your 62nd birthday in 2017 or soon after, you’re in the vanguard of a big change in Social Security: Starting...

Read more

LEAVING THINGS TO CHANCE

This week’s article hit the nail on the head when it said “Whether your retirement is 20 years away or two, it’s good to see you are not leaving it to chance. Retirement could last decades, so it’s...

Read more

THE RISKS AND PROCESS OF RETIREMENT

I came across the results of a survey conducted online of Americans ages 45 to 80 the purpose of which was to evaluate Americans’ “awareness of potential financial risks in retirement, how this...

Read more

WHAT DOES THAT REALLY MEAN?

It is always important to understand what is really meant by the words used by someone trying to give you advice on your retirement planning. That is why we thought to share with you a list of some...

Read more

THE NEXT BIG THING

I thought to share this week’s article with you when I read “Retirement could last decades, so it’s smart to look into ways to grow and protect your nest egg for the long run.” Decades is a long...

Read more

DO YOU NEED A SECURITY BLANKET?

It is not difficult to understand why, as this week’s article reports “Americans routinely report anxiety about money, particularly middle-aged people,” especially when they begin to think about...

Read more

REPLACEMENT RATIO

Someone asked me the other day to explain to them what a “Replacement Ratio” meant and so I thought to share this with you. Typically the phrase refers to the percentage of pre-retirement income...

Read more

HOW READY ARE YOU FOR THE NEXT BIG THING?

This week’s article tells us “Whether your retirement is 20 years away or two, it’s good to see you are not leaving it to chance. Retirement could last decades, so it’s smart to look into ways to...

Read more

CAN YOU AFFORD IT?

What are the options for obtaining a steady stream of income when we are elderly and really need it? This week’s article discusses how “an annuity can ensure that a retiree is able to afford...

Read more

DON’T BE HEARTBROKEN

This week’s article hit the nail on the head when it referred to FIAs as a “good long-term relationship for all”. The author cited five good reasons why you should “love a FIA”: 100% Principle...

Read more

MISUNDERSTOOD

I found this week’s article interesting and thought to share it with you as it addressed some basic principles of a long-term retirement option. “Let’s start with defining FIAs. These products are...

Read more

WHY YOU NEED TO KNOW

I thought you might want to read this week’s article because it was very direct about why you need to know how Annuities work. The author states that the reason is because “90% of [retirement]...

Read more

WHAT KIND?

If you are anything like me, you become frustrated when financial conversations around you include terminology that everyone assumes you understand. While it is an understandable language to say...

Read more

ARE YOU ONE IN FIVE?

Would it surprise you to learn that one in five Americans have absolutely nothing saved for retirement? This week’s article tells us that “As of right now, nearly 90% of Americans admit that they...

Read more

NO BETTER TIME THAN THE PRESENT

This week’s article speaks to the fact that “living comfortably in retirement is indeed possible”. To achieve this goal, it is important for retirees to develop a “strategic plan that allows...

Read more

CONSIDER YOUR FUTURE OBLIGATIONS

Annuities are usually discussed in the context of planning for retirement, but have you ever considered the use of an annuity to meet other types of future obligations or needs? This week’s article...

Read more

A SIMPLE WAY

This week’s article discusses how most people crave guaranteed income in retirement. In fact “six in 10 people ages 55 and older place a value on having guaranteed income to supplement what they’ll...

Read more

RETIREMENT COMMUNITY RETIREMENT INCOME

We often think of retirement communities as providing us only with housing and perhaps a few amenities. This past week I came across one that offered out an analysis on Annuities. The reason being...

Read more

FINANCIAL CERTAINTY IS POSSIBLE

In a new article published by Forbes, an author writes how “removing some uncertainty surrounding retirement is indeed an obtainable goal all Americans can strive to achieve.” I’ve provided a link...

Read more

AT WHAT AGE?

I liked this week’s article because it answered the question “At what age should you purchase an indexed annuity?” The author tells us that “the great thing about fixed indexed annuities is that...

Read more

PLAYING A GAME

I saw an article this past week which spoke about a new interactive game called “Master of Retirement” and thought to share it with you. Surveys power the game’s questions and offer out informative...

Read more

MORE LIFETIME INCOME

This week’s article discusses how “recent research by retirement income expert and former U.S. Treasury Department official Mark Warshawsky shows that immediate annuities generally provide you with...

Read more

HISTORY

Did you know that the “concept of annuities dates to ancient Rome, but the first record of annuities in America comes from the Colonial period. In 1759, a company formed to provide a secure...

Read more

SHOULD YOU TAKE A LUMP SUM FOR RETIREMENT?

This week’s article caught my eye when it said “It turns out, many retirees choosing to take their employer’s 401(k) or pension as a lump sum for retirement are taking their lumps.” A survey...

Read more

A SLAM DUNK

I read a good Consumer Reports article the other day that discussed when there isn’t enough saved to meet a retirees expectations in retirement. The article states “Fortunately, there are a number...

Read more

CRISIS IN RETIREMENT PLANNING

The Harvard Business Review published an interesting article explaining how when interest rates and stock prices both plummeted, “the value of pension liabilities rose while the value of the assets...

Read more

FACTS + STATISTICS

A Government Accountability Office (GAO) report referenced in this week’s article “highlights the role annuities can play in helping people secure enough income during retirement.” With so many of...

Read more

NEW DATA

This week’s article emphasizes that “Americans need to take additional steps in order to ensure a financially stable retirement – one that allows them to pay for medical bills and essential costs...

Read more

DIFFERENCES CAN MATTER

Do you understand the different types of insurance coverage that you own? This week’s terrible hurricane has brought to light the devastating effect that nuances in an insurance policy can have on...

Read more

BUT WHAT DOES THAT MEAN?

Sometimes it is important to go back to basics and talk about the meaning of words that are often used when discussing options for getting that lifetime income you need. “Annuitization is one asset...

Read more

SHORTFALL OR SURPLUS?

We have often discussed that one of the biggest risks to a comfortable retirement is running out of money too soon. Sometimes the difficulty is in figuring out where you stand, so I thought to...

Read more

WHAT IS IT?

The other day a friend told me that sometimes it was easier to explain what something was by telling what it was typically used for. This week’s article does a good job of telling us that “the...

Read more

ARE YOU SURE YOU KNOW WHO YOUR BENEFICIARIES ARE?

This week’s article provides some resources I thought to share with you relating to beneficiary designations on financial assets such as checking, life insurance and retirement accounts. Because...

Read more

SUMMER TIME

This week’s article writes about topics on all of our minds right now, summer vacation! Just as you may have been busy this past year planning ahead, saving and budgeting both your time and money...

Read more

DO YOU HAVE A DEFINED CONTRIBUTION OR BENEFIT?

This week’s article tells us that the typical U.S. household has few retirement savings, and that most people rely on social security. One of the reasons is the reduction in employers offering any...

Read more

GET CONFIDENT

“Imagine trying to take an around-the-globe trip without looking into the details. In essence, that’s what millions of Americans do every day as they ponder retirement. They head out on the journey...

Read more

EDUCATING

We believe in educating our clients, and appreciate the frustration that can occur when conversations about retirement planning include words that may be new, or difficult to understand. Because of...

Read more

INFLATION’S IMPACT ON YOUR INCOME

We often talk about retirement in terms of understanding what expenses will be, and then comparing that to sources of income. An additional factor in this equation for retirement that is sometimes...

Read more

SAVING WHILE PAYING OFF LOANS

Whether we are dealing with personal loans like paying off a home or car, or having discussions with family members about paying student loans, the conversation often circles back to the heart of...

Read more

THE SECRET

This week’s article that I thought to share with you is called “The Secret to Generating Lifetime Income.” It states that “one solution to help ensure lifetime income is adding a fixed indexed...

Read more

AT LEAST ONCE

“While a whopping 94 percent of Americans currently give themselves a passing grade on retirement, a third of them have confessed to stopping retirement savings at least once”, according to a new...

Read more

RIGHT OR WRONG ONE FOR YOU?

The editor of this week’s article wrote that “An annuity can be a very smart retirement investment for many people. That’s not just because an annuity can provide a secure revenue stream — a...

Read more

NOW THAT IT IS MAY

Now that it is May and tax season is behind us, it may be a good time to reassess how retirement has impacted or will impact your living expenses. This week I thought to share with you a chart that...

Read more

CAN AN UP MARKET SINK YOUR RETIREMENT?

This week’s article made me think about the old adage “What goes up must come down.” Getting older always seems to involve a race against time, and if you know that you have to live off of your...

Read more

CHOICES

This week’s article discusses the situation when a company offers to cash out the pensions of certain retirees and former employees and instead give them a lump-sum payment. In the past we have...

Read more

PREDICTABLE INCOME

A common concern when planning for retirement is the difficulty in knowing exactly how much income the retiree will have, and how long that income will last. It is also sometimes difficult to...

Read more

GLOSSARY OF TERMS

From time to time we come across publications that are beneficial for anyone owning or thinking of owning an annuity to have. This week’s publication is a glossary of terms that are often used when...

Read more

DO YOU HAVE AN ILLUSION OF WEALTH OR AN ILLUSION OF POVERTY?

This week’s article tells us that “A new study has found that one difficulty workers saving for retirement have in judging whether they’re on track is that they could be under the “illusion of...

Read more

QUESTIONS TO ASK

We always enjoy finding articles that help you to make good decisions for your financial future. This week’s article is one of those as it suggests some questions to ask that help determine what a...

Read more

HOW OFTEN?

If you have ever wondered how often you should review your annuity portfolio, this week’s article tells us it should be done “as often as you would your other investments”. This is one of the...

Read more

BRIDGE THE GAP

I wasn’t really surprised to read in this week’s article that “When it comes to savings, the gender gap is huge. A recent study indicated that women have 50% lower savings than their male...

Read more

HIGH TECH OR HIGH TOUCH

This week’s article reminds us that “While high-tech solutions offer tremendous convenience, some things are still much better when they are high-touch. One of these things is retirement planning...

Read more

BASIC BUILDING BLOCKS

This week’s article begins with a thought we have often discussed; “Annuities have long been the basic building blocks of the U.S. retirement income system.” Economists generally agree that many...

Read more

GROWTH POTENTIAL BUT MORE IMPORTANTLY PRINCIPAL PROTECTION

I found this week’s article timely as the markets rise and dip. This week’s article says that “Fixed Indexed Annuities combine the stability and guarantees of a fixed product with growth potential...

Read more

ADVANTAGES

With President’s weekend fast approaching, we can’t help but think more about helping those veterans amongst us. This week’s article states that “Veterans preparing for retirement may purchase...

Read more

OLDER COUPLES BOTH EMPLOYED

I don’t know about you, but I have often wondered if in the end it really makes a difference, when all is said and done, if both spouses worked prior to entering retirement. I read a study that I...

Read more

BRINGING BALANCE

“In our hectic lives, balance is something many of us strive to achieve.” This week’s article caught my eye with its first sentence, as the thought of balance rang resonant with what we have always...

Read more

OLDER AMERICANS WORKING LONGER

Did you know that “Older Americans are working longer and claiming their Social Security benefits later, new research from the Social Security Administration shows.” This week’s article reminded me...

Read more

SOMETIMES IT’S FUN

Sometimes it is fun to take a moment and participate in a quiz about retirement. Answering questions and then comparing our responses to others gives us new opportunities to think about the choices...

Read more

ARE YOU UNDERSAVED FOR RETIREMENT?

I thought you might like this week’s article because it contains several videos aimed at raising your “Retirement IQ”. Did you know that “A startling number of baby boomers don’t know how much...

Read more

RETIREMENT SECURITY BLANKET

This week’s article tells us that “One of the biggest fears among retirees and soon-to-be retirees today is that they will outlive their retirement savings. With life expectancies in developed...

Read more

LET’S LOOK BACK TO LOOK FORWARD

As we come to the end of the year I thought to share with you a group of articles that I have found to be informative, each of them reflecting on different issues relating to planning for...

Read more

IF YOU LIVE LONGER

“Imagine sitting down on the day of your retirement to plan your financial future. You know what your annual expenses have been and you want to maintain your current standard of living. So, you...

Read more

A STREAM OF CONSUMPTION IN RETIREMENT

This week’s article states that “Individuals engaged in financial planning for retirement have no shortage of resources available to provide guidance on how much to save and how to invest those...

Read more

DEFINED BENEFIT OR DEFINED CONTRIBUTION

This week’s article, found in an issue of the Harvard Business Review, was of interest to me because it described very simply the difference between and shift from Defined Benefit retirement plans...

Read more

SUCCULENT SAVINGS

After what I hope was a hearty Thanksgiving day meal, I thought you would enjoy this article which suggests that you “consider throwing a new recipe onto your menu. Ingredients like contributions...

Read more

ALWAYS LEARNING

I read an article this week that was directed toward teachers who were revisiting their retirement plan “for when they are no longer lesson planning.” One section of the article in particular...

Read more

HARD TO UNDERSTAND YOUR EMPLOYER PLANS?

Sometimes, no matter how hard we try, it is difficult to understand if changes in our employer pension plans are actually advantageous to us. That’s why I thought you might want to read this week’s...

Read more

STRUGGLING TO SAVE

“Why do you think Americans struggle to save for retirement?” This was one of the questions posed to an retirement expert in this week’s article. His response was “If I told you that people spend...

Read more

RETIREMENT IQ

This week’s article takes a close look at “new research that shows a startlingly low retirement IQ” Staying informed and being educated are important and so I thought to share with you three tips...

Read more

HEALTH CARE: CAN ANNUITIES HELP COVER THE COSTS?

This week’s article tells us that a new study confirms that “America’s senior citizens have their backs to the wall financially.” “With the threat of financial ruin so prevalent, seniors need to...

Read more

BABY BOOMERS AND LOW RETIREMENT IQ

This week’s article tells us ” While many Americans believe they’re retirement savvy, the average baby boomer has trouble answering even simple retirement questions. New survey data shows folks...

Read more

EDUCATION AND RETIREMENT INCOME

This week’s article tells us that “While some recent studies have identified a decrease in the return to education as the labor market changes, education has a proven impact on lifetime income.”...

Read more

MAKING BETTER DECISIONS

Weekly we try to provide you with information that may help you in your retirement planning. Sometimes that information is obtained from studies conducted through the use of a survey. You may ask...

Read more

IDENTIFY SHORTFALLS IN YOUR RETIREMENT INCOME STREAMS

This week’s article reminds us to ask the question “Now that you have created a retirement expense budget and have created a retirement income stream, how do they match up? Do you have enough...

Read more

DO YOU DRIVE IN THE FAST LANE OR THE SLOW LANE?

“On your way home from work, do you drive in the slow lane or the fast lane? Each person has a different propensity for risk. When investing, this risk propensity can be used to determine the...

Read more

RETIREMENT PITFALLS

Sometimes it is a good idea to review your retirement planning strategy and ask yourself if you are taking action that is sufficient to avoid some common pitfalls. This week’s article reminds us of...

Read more

OVERCOME FEARS AND TAKE ACTION

We have often spoken about how surveys “find Americans are most afraid of their money running out before their life runs out.” But this week’s article states that “they’re equally afraid that while...

Read more

DEBT IN RETIREMENT

We’ve spoken in the past about having adequate income during retirement, and have from time to time provided tools for estimating future financial needs. That’s why I found interesting this week’s...

Read more

DIFFERENT RETIREMENT PRODUCTS

“Life is unpredictable.” This comment caught my eye in an article I read concerning “different retirement products and savings strategies that seem to be everywhere we look these days.” The article...

Read more

DID YOU KNOW?

Did you know that “Americans are not taking the necessary steps to put saving for the future over current expenses. In fact, a quarter of Baby Boomers – the age group closest to retirement – have...

Read more

FEARS

This week’s article caught my attention by the manner in which it addressed an issue we talk about frequently. The article’s opening paragraph was “Imagine fearing life more than death. That’s a...

Read more

DEBUNKING MYTHS

Often times people find themselves in the middle of conversations where the speaker is telling them things that relate to their retirement planning, or other financial matters and what is being...

Read more

HOW ANNUITIES WORK

This week’s publication may be of interest to you because it discusses a wide range of topics surrounding annuities. It tells the reader that “Annuities may help you meet some of your mid- and long...

Read more

WHAT OLDER ADULTS NEED TO KNOW ABOUT MONEY

This week I thought to share with you a publication that addresses five important financial issues of interest to older adults: “Social Security, health and long-term care insurance, later-life...

Read more

VACATIONS AND RETIREMENT

Did you know that people spend more time planning their summer vacations than they do for their retirement? So said one study that is quoted in this week’s article. “While a vacation may last a...

Read more

RETIREMENT QUESTIONS FOR A JOB

Often, we think of retirement only as we are leaving our employment. This week’s article suggests we think about it when we evaluate a job offer, and that we factor in the value to a job offer what...

Read more

CALCULATORS

This week we thought to share various Money and Retirement Tools in order to assist you in determining your financial resources and needs. It is a good idea to always have a clear understanding of...

Read more

THOSE WHO PLAN

Did you know that “those who plan are estimated to save more than 3x those who don’t”? This week’s article reminds us of this. We’ve always thought that budgeting was important, especially when...

Read more

WEALTH ACCUMULATION AND INCOME YOU WON’T OUTLIVE

This week’s article speaks about the emergence of Fixed Indexed Annuities (FIAs) “as a top choice for soon-to-be retirees due to their potential for wealth accumulation.” We have spoken in the past...

Read more

RETIREMENT READS

If you’re anything like me, you may not always have time to read an article or book that catches your interest. Because of that, I thought you might like this week’s article as it provides a re-cap...

Read more

HAPPY BIRTHDAY

Did you know that 21 years ago Fixed Indexed Annuities were first introduced to consumers “as a key product for helping plan a secure, dependable source of income for retirement”?Year in and year...

Read more

RETIREMENT INCOME OPTIONS FOR WORKING FAMILIES

I came across a press release issued by the U.S. Department of the Treasury a little less than a year ago, and thought to share it with you. J. Mark Iwry, Senior Advisor to the Secretary of the...

Read more

DO YOU KNOW THE DIFFERENCE?

I wanted to share with you an article that explained the differences between an annuity and life insurance. I liked not only the explanation, which I found simple and straightforward, but also the...

Read more

BACK TO BASICS

Sometimes it is important to go back and review the basics. I thought to refer you to this week’s article because I think it does a good job of highlighting some basic information about annuities....

Read more

WILL YOU BE DRAWING DOWN ON ASSETS IN RETIREMENT?

This week’s article was interesting to me because it said that “buying an annuity that generates lifetime income could very well be a good move [for retirees] as a variety of studies show that...

Read more

GIVING

This week’s article on the topic of Giving reminds us that at this time of year when we think about what gift to give to our loves ones “ it’s worthwhile to take some time and consider whether the...

Read more

GUARANTEES OR DREAMS AND HOPES?

Many of us think of our 401K or IRA account as the source of our retirement income. The question is, how much income will it provide? Regardless of the amount of money we have saved, it is...

Read more

THINKING TOWARD THE FUTURE

As we close out 2015, it seems appropriate to reflect on the past year and plan for the future. A comment in this week’s article caught my attention as it seemed to do both. ”Fixed-index annuities,...

Read more

GUIDANCE

Over a year ago I read an article that appeared on the US Treasury Department’s website that stated “In order to help retirees manage their savings and ensure they have a stream of regular income...

Read more

ACCUMULATE MORE WEALTH

Most of us have read that females, on average, live longer than males. This week’s article takes this information and applies it to retirement planning. Discussing how women “need to accumulate...

Read more

ONCE THE KIDS ARE AWAY, THE PARENTS WILL PLAY

While many couples find they have more disposable income when they become empty nesters, this week’s article talks about what often happens to that money. “It turns out that when the last of their...

Read more

DIFFERENT OPINIONS?

It is human nature to want a second opinion, whether it be for an ailment we might have or in response to the question “What can I do to better prepare for my retirement?”. That’s why I thought...

Read more

QUESTIONS ANSWERED

The first of six questions that this week’s article asks is “Am I investing in an annuity to save for retirement or generate guaranteed retirement income, or both?” Asking this question highlights...

Read more

SHORTFALL OR SURPLUS

“One of the biggest risks to a comfortable retirement is running out of money too soon.” This week’s article gives you the ability to determine your projected shortfall or surplus at retirement by...

Read more

MISTAKES PEOPLE MAKE

I was surprised to read in this week’s article that “the average 65-year-old couple will pay $240,000 in out-of-pocket costs for health care during retirement.” This expense, which many retirees...

Read more

HOW DO THEY WORK?

I read an article this week on “How do fixed index annuities work?” and thought to share it with you. The article explains that the money used to buy the annuity is invested by the insurance...

Read more

INCREASING INCOME WHEN THE ODDS ARE STACKED AGAINST YOU

This week’s article was interesting to me because it referenced recent articles that suggest “retirees refrain from withdrawing any more [from their retirement account] than they are allowed under...

Read more

MANAGING RISK

This week’s article discusses managing risk with Fixed Indexed Annuities. The author writes that in “the past decade, the financial market has experienced extreme swings and with such volatility,...

Read more

BENEFITS GUIDE

If you’re anything like me, you may like to have hard copies of documents that discuss topics that are important to you so that you can refer back to them when you have questions. That’s why I...

Read more

ARE YOU FULL RETIREMENT AGE NOW OR IN THE NEXT SIX MONTHS?

We believe it is important for you to be informed, and wanted to provide you with this week’s article because it is time sensitive and discusses strategies phased out as part of the Bipartisan...

Read more

WEATHERING THE STORM

This week’s article references a forum that was held this past week called “Weathering the Storm: Forum on Volatile Markets” which “discusses the challenges of today’s financial market, and more...

Read more

AGING IS NOT A TREND, IT IS HERE TO STAY

I was caught by one of the statements made in an article I heard this week and thought to share it with you here. “The smart investor will look beyond the ”baby boomer bulge” headlines and...

Read more

PREDICT THE FUTURE?

“Rather than attempting to predict the future, why not alleviate risk with a diversified retirement plan? FIAs are reliable products that can provide peace of mind and balance to anyone’s portfolio...

Read more

TAKEAWAYS

Following up on a presentation in DC where industry professionals and policy makers addressed “major challenges Americans face today when it comes to planning for retirement and responsibly...

Read more

WORK, RETIREMENT AND FINANCIAL SECURITY IN THE 21ST CENTURY

WORK, RETIREMENT AND FINANCIAL SECURITY IN THE 21ST CENTURYThis week’s article, written by the President of the Transamerica Institute and Executive Director of the Aegon Center for Longevity is...

Read more

View more